File Tax Returns Through Digital Channels

The preparation process took too much time and money. Fifteen employers worked continuously the entire year. There were a lot of mistakes because of manual labor. A client’s business couldn’t grow exponentially before this part of the process was automated.

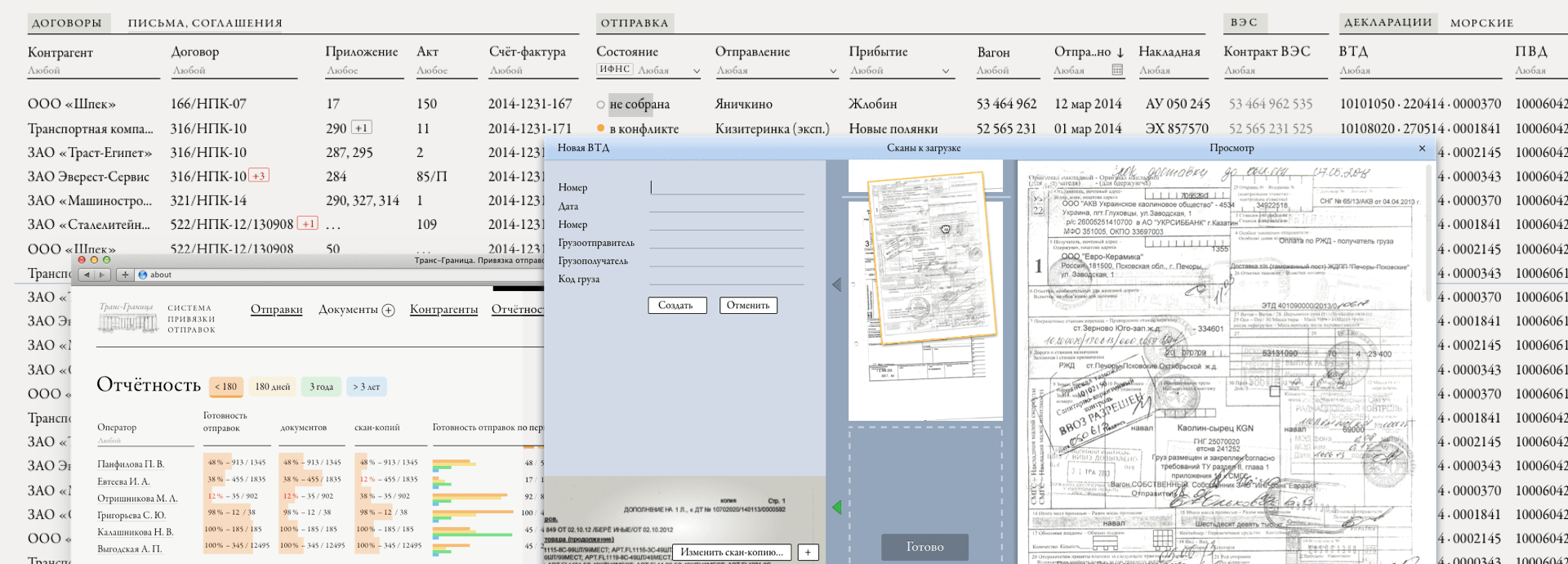

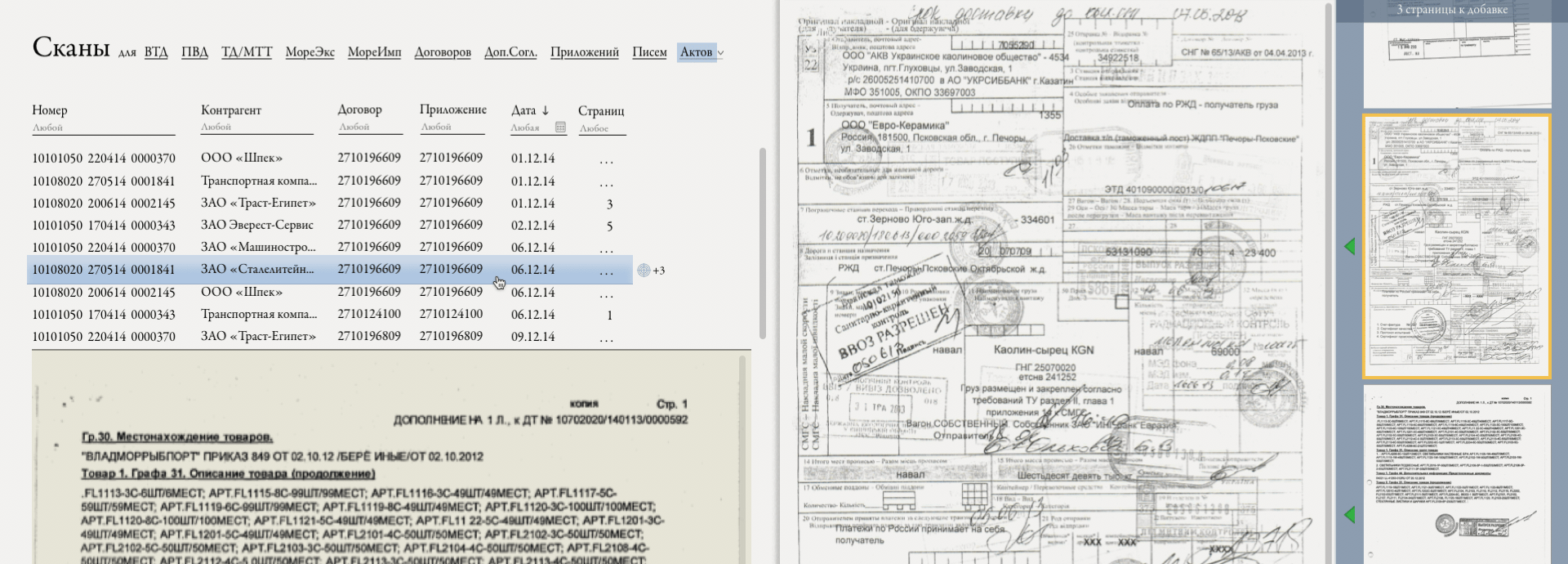

Byndysoft discovered business opportunities and suggested developing a new system for total automation. One of the most important parts was working with electronic document versions:

- Scan the original paper-document

- Gather data from the scanned documents

- Edit metadata and link necessary documents

- Resolve conflicts in the data

- Check the data for correctness and completeness

The system outputs a package of the documents compiled in the special format acceptable for the secure digital channel of the Internal Revenue Service. One package contains about 30GB of documents and metadata.

Byndyusoft designed and developed an automated system that packages and sends all necessary documents in paperless format to the Internal Revenue Service. We decreased the time in gathering data by 2 times, and reduced mistakes to almost zero.

The system has launched and has already sent 9 packages to the Internal Revenue Service successfully.