Digest of Case Studies in January 2017

In this digest: Portable Data Terminals, Fraud Detection, Real-time Business Monitoring and File Tax Returns.

Programming Portable Data Terminals for Optimizing the Inventory Process

A big retail company asked Byndyusoft to optimize the inventory process because it took a lot of time and didn’t give the necessary level of control for the stock in the warehouse.

In the previous process, an inventory inspector checked only an item’s existence but couldn’t analyze its characteristics, such as weight, size, etc. Also, inspectors had too many manual and drudgery tasks that should have been automated. As a result, the inventory process didn’t recognize violations in stores on time.

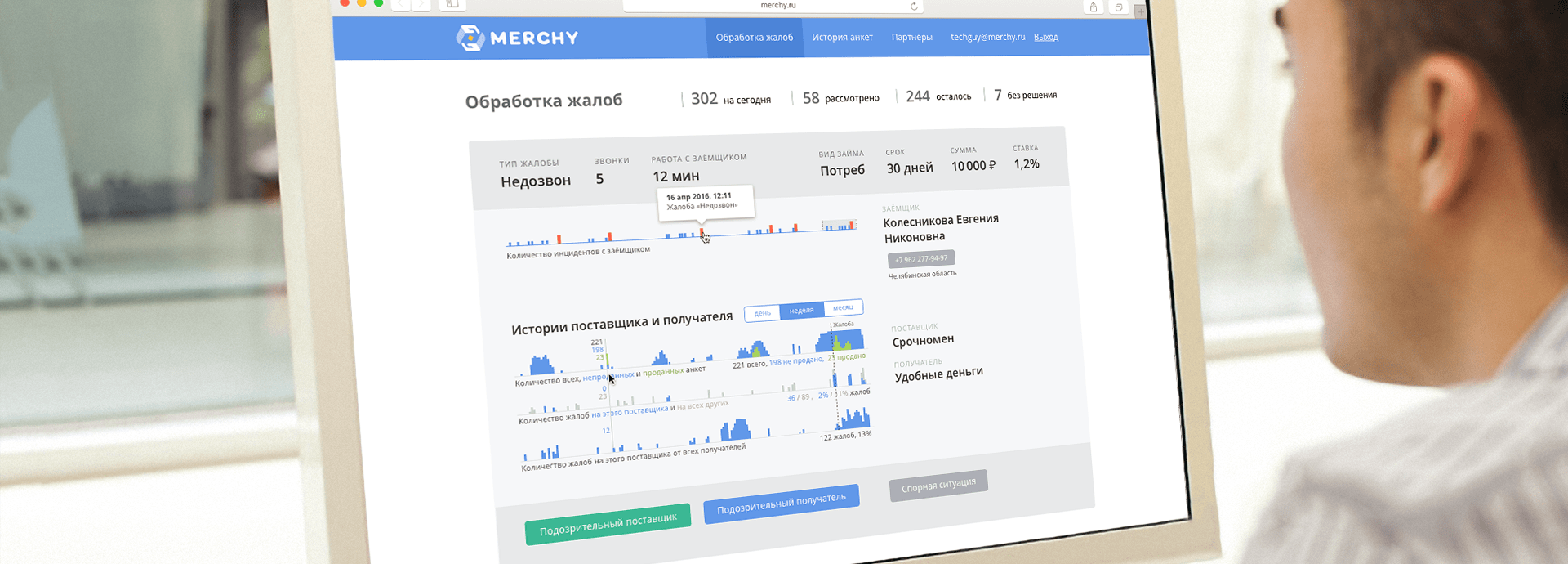

Fraud Detection Dashboard UI

Credit suppliers trade useless credit applications to other credit suppliers who may find them useful.

If these applications don’t have enough information or the information is incorrect, a buyer issues a claim. Both the seller and the buyer were found cheating. One sold bad applications intentionally, and the other put claims on the good applications.

To stop the fraud the moderators need to decide quickly and precisely who is the cause.

Real-time Business Monitoring and Intelligence

A client didn’t have a tracking system for monitoring performance and business parameters in real-time. The most desired feature was to predict a critical problem with an early warning alarm.

The client asked Byndyusoft to develop a monitoring system for his high-loaded project: up to 10,000 messages per second and database storage up to 5 TB.

Such a huge project is very sensitive to any additional stresses. It’s really hard to set up a monitoring system and not reduce the performance of the whole system especially if you need to monitor the complex business parameters with prediction analysis.

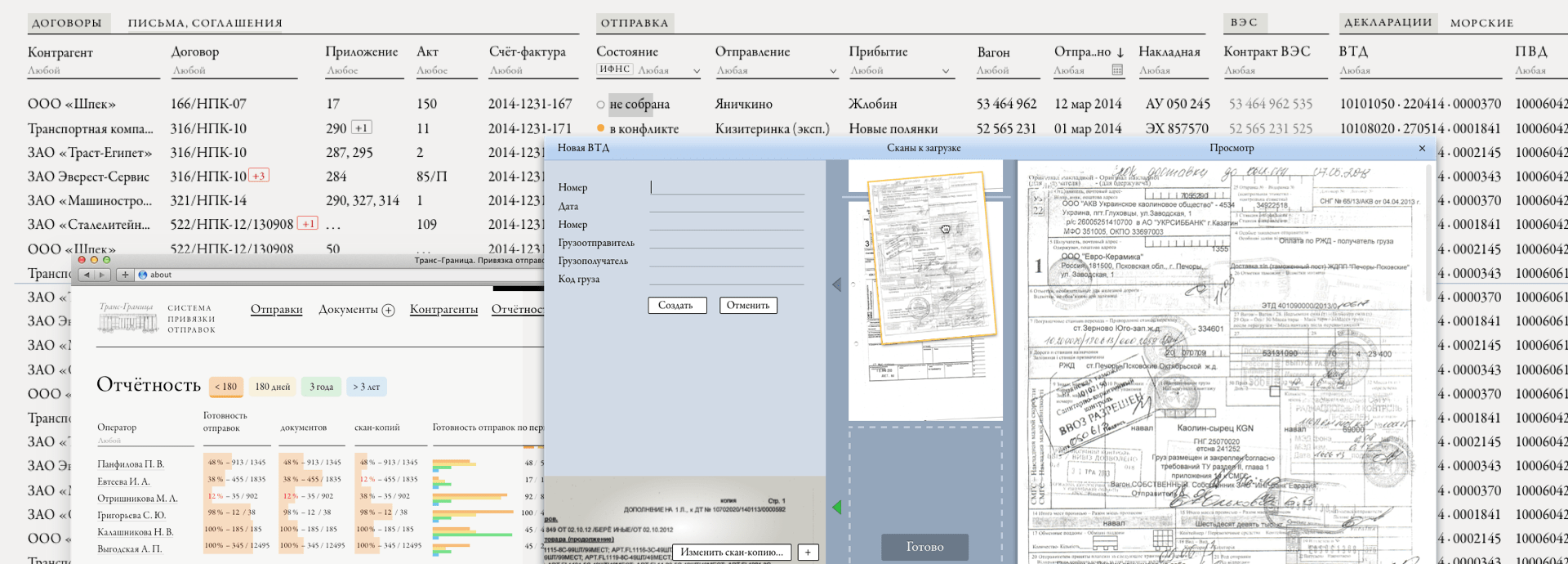

File Tax Returns Through Digital Channels

A logistic company, that specialized in railroad delivery, had prepared 600 000 paper pages of tax returns every year. They literally sent 4 trucks loaded to the top with paper to the Internal Revenue Service.

The preparation process took too much time and money. Fifteen employers worked continuously the entire year. There were a lot of mistakes because of manual labor. A client’s business couldn’t grow exponentially before this part of the process was automated.